Written by: jim, dougie (figment capital), marc (avy), krane (asula)

Thanks to rajiv and rahul for their thoughtful comments and feedback.

Introduction

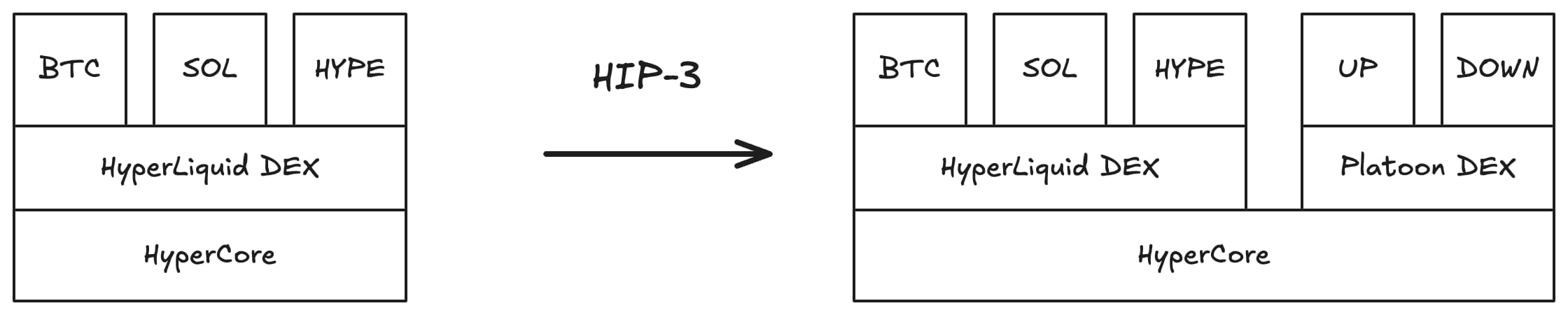

HIP-2 and HIP-3 provide a meaningful improvement in decentralized market creation by enabling permissionless, builder-deployed spot and perpetual (perp) markets on Hyperliquid. By allowing permissionless access to its orderbook and the HyperCore matching engine, Hyperliquid is commoditizing the infrastructure that made it so popular in the first place. This commoditization should enable innovation in other segments of the market since builders don’t need to spend months or years building out their own orderbook infrastructure anymore. We believe Hyperliquid’s HIP-2 and HIP-3 offers a greenfield opportunity for experimentation in market design, market creation, and liquidity provision.

In this piece we’ll talk about innovations across the different axes that form the crux of HIP-3. We’ll segment the different axes across: stake accumulation for deployments, market design and fee distribution. Towards the end of this post, we’ll also discuss fee structure innovations and prime brokerage models we expect to see if HIP-3 truly becomes popular.

HIP-3

Centralized exchanges have murky listing processes with an acute lack of transparency. Even CZ believes that CEXs should list all assets automatically, but this is not possible on CEXs today for a variety of reasons— due-diligence limitations, exchange policies and expensive liquidity provision — HIP-2 and HIP-3 make it possible for this to take place on Hyperliquid. Even if Hyperliquid doesn’t become the dominant onchain exchange, we expect any winner in this category to host builder-deployed spot and perps markets as table stakes.

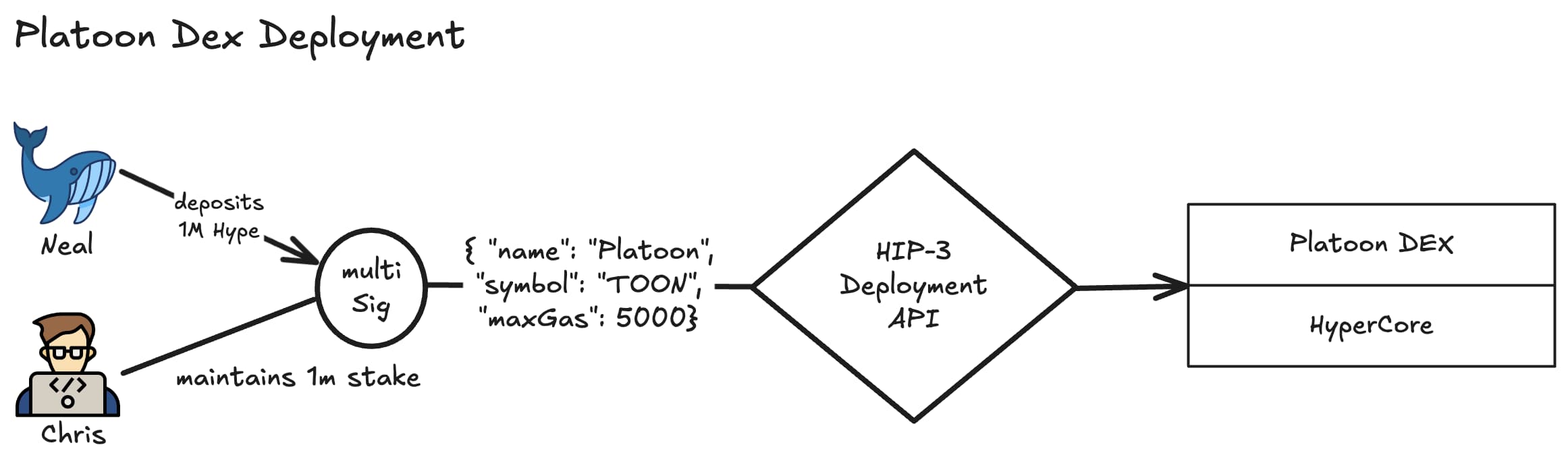

Before we dive into the design space for builder-deployed perps, let’s first discuss HIP-3 in a bit more detail. HIP-3 introduces permissionless, builder-deployed perpetual markets on Hyperliquid’s Layer-1. To deploy a market, builders need to bond 1M staked HYPE which can be slashed in the case of byzantine behavior from the deploying builder. More specifically, any builder with 1M HYPE can deploy a new DEX using the same infrastructure as Hyperliquid’s flagship DEX.

Builder-deployed DEXs can be easily deployed via an API call once 1M HYPE has been bonded (NB: throughout this piece we’ll use the illustrative example of the aforementioned Platoon DEX to make it easier for readers to follow along).

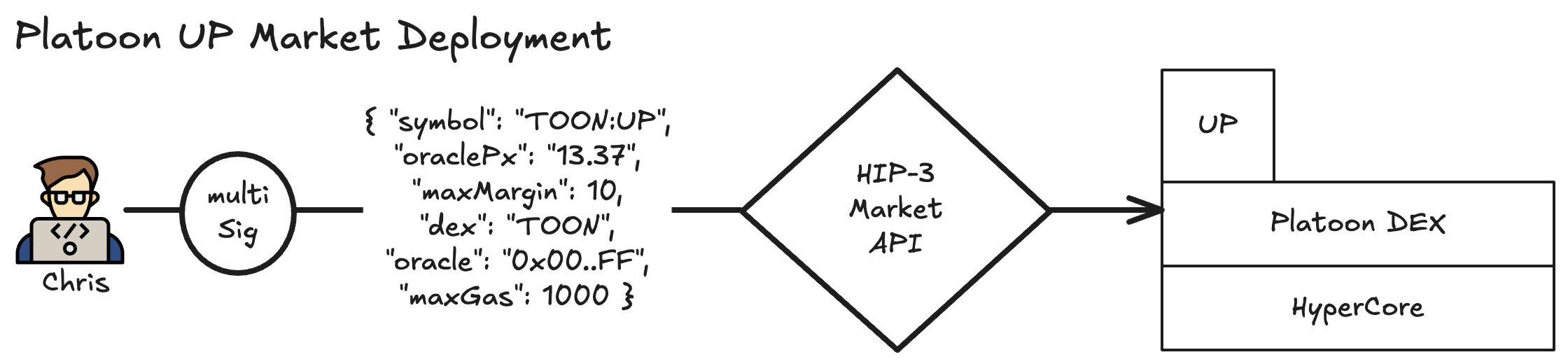

Listing new markets once the DEX has been deployed is also a simple API call where the builder specifies the symbol for the market, margin requirements, and an address for the oracle. Future iterations of HIP-3 will also enable multiple collateral tokens per DEX. Therefore, the UPSIDE ($UP) market may soon allow USDC and BTC to act as collateral tokens.

NB: The deployer can themselves set a fee share of up to 50% when they deploy these markets.

Over time, we expect Hyperliquid to transform into infrastructure that houses many different exchanges with their own disparate markets and interfaces. Each of these exchanges will innovate on different aspects of DEX-design. Throughout this piece, we’ll focus on three separate aspects of the design space: staking, fee utilization and market types.

Since, there’s a meaningful hurdle when deploying markets, we’ll first talk about ways to lower this hurdle before moving onto fee utilization and market types.

Staking

Hyperliquid enforces 1M HYPE staked as a bond for any new perpetual DEX creator to ensure integrity and protect users. This bond aims to deter spam, align incentives between the new DEX and HYPE holders, and commoditize trust; validators can slash a creator’s stake during a 7-day unstaking window if the creator acts maliciously. This is one area where much of the innovation from PoS staking mechanisms can be applied.

The base case is one in which the creator holds 1M HYPE or has the cash to buy 1M HYPE and deploys their markets. In our previous example of the Platoon DEX, one of the creators, Neal, had sufficient HYPE to bond and deploy markets. However, this is an unlikely base case.

Delegated Staking

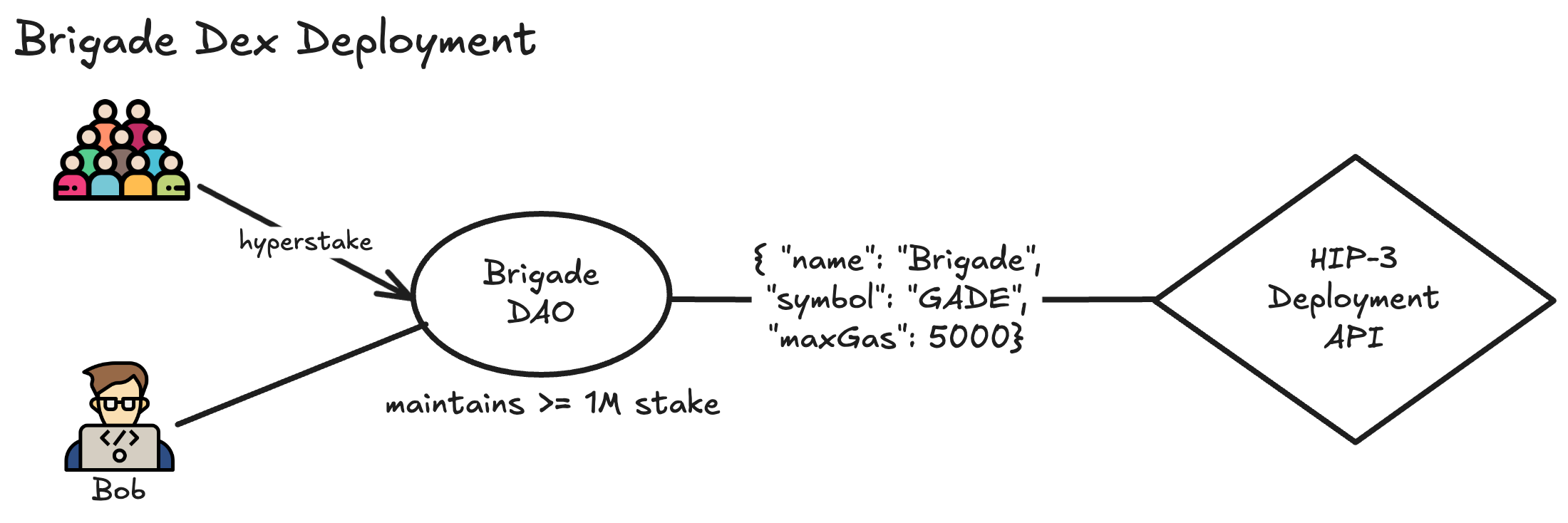

Builders can allow a collective of HYPE holders to delegate their HYPE to them. The builder can then deploy their own DEX and have a process for market listings. In return for their stake, stakers would earn a percentage of the fees from the deployed markets. Mechanisms for market deployment can include:

- The builder entity employs analysts who scan markets to identify and choose which markets to deploy. This gives the builder greater authority over the direction of the DEX.

- The builder entity may act as a DAO, thus allowing any analyst to propose new markets. Stakers vote on the analyst’s proposal. If a proposal passes, the proposing analyst earns a percentage of the trading fees from the market. However, this approval process invites some time-to-market delays.

This simple strategy can derive a lot of conventional wisdom from traditional PoS systems to deal with the “nothing at stake” problem or challenges around governance/coordination. However, as the number of markets in a DEX grows, the risk stakers are exposed to also grows. This is similar to the increasing risks applied to restaking, if stakers restake their tokens to many different services.

Tranching Slashing Risk

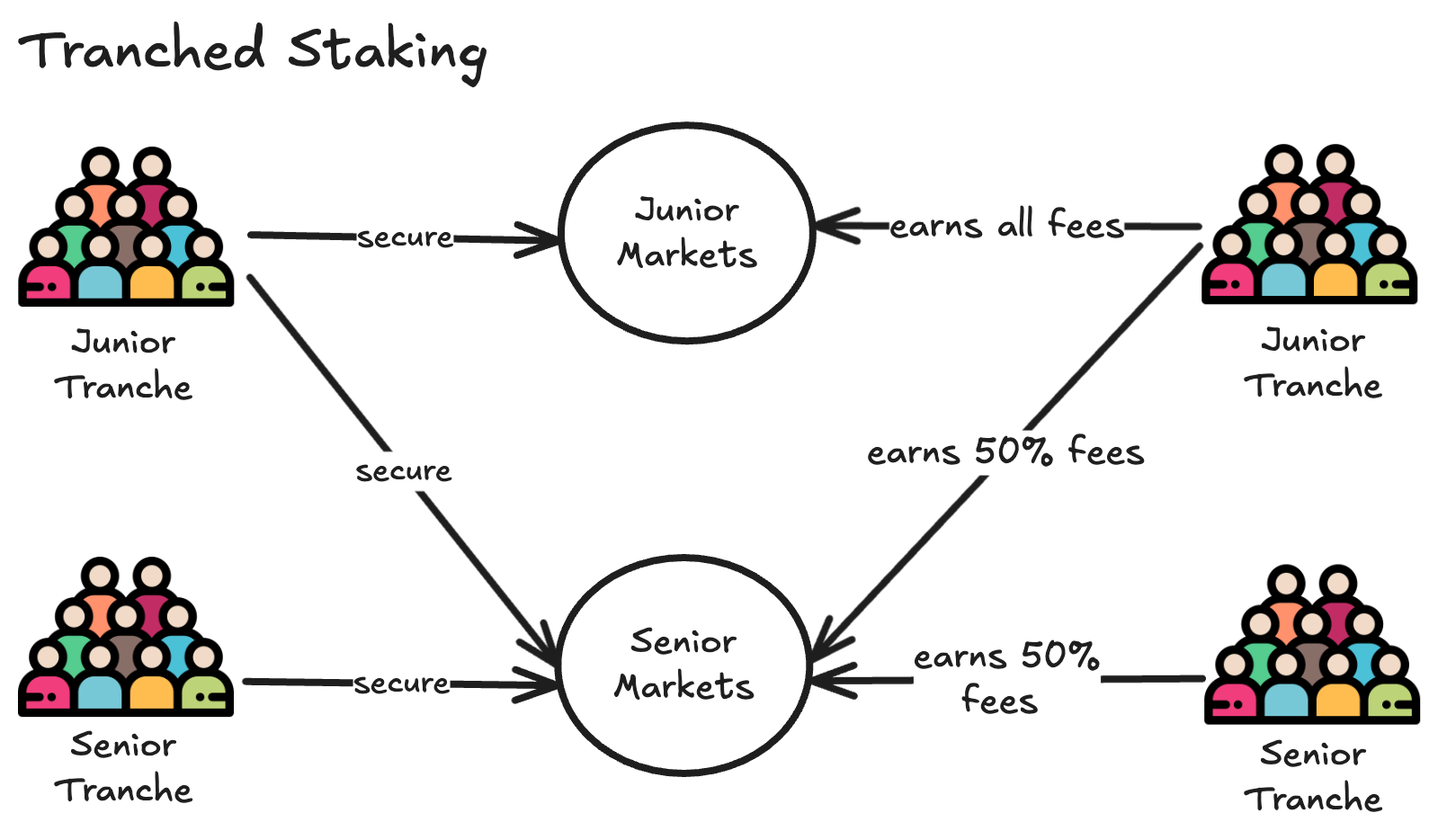

Risk tranching is a technique that can be employed to deal with the increasing risk of deploying new markets. Not all stakers have the same risk appetite – some might be willing to take on higher slashing risk for higher returns, while others want safer, steadier yields. By structuring the stake into senior and junior tranches, a builder could accommodate both profiles:

- Junior Tranche: The junior tranche would secure all markets deployed to the DEX. The junior tranche would be composed of 500k HYPE and take on 100% of the slashing risk, should any of the “higher risk” markets in the DEX get slashed. In return, they can capture all the fees these high risk markets generate.

- Senior Tranche: Senior stakers face lower slashing risk since they only secure “lower risk” markets. The senior tranche would also be composed of 500k HYPE. Naturally, the senior tranche would only earn fees from the markets they secure.

The junior and senior tranches can split the revenue from the senior markets equally. The innovation here is that it isn’t necessary to treat all the HYPE in the staking bond as fungible. Instead we can allow stakers to choose their own risk profile.

Fee and Stake Utilization

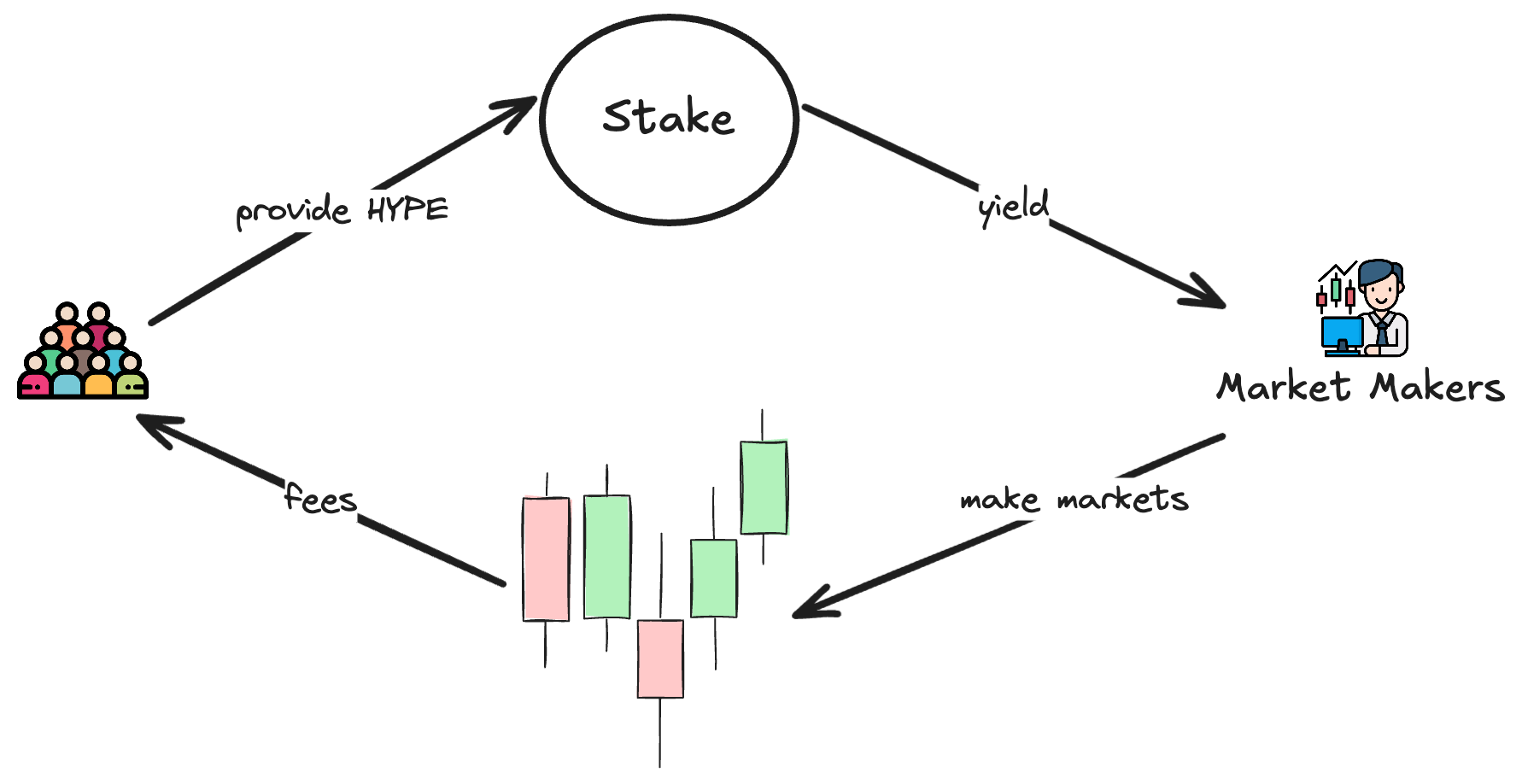

While the most obvious incentive model for a HIP-3 DEX might be to pass fees back to stakers, there are other strategies that can directly incentivize liquidity and allow the DEX to invest earnings into its continued growth.

Incentivizing Liquidity

Let’s consider a delegated staking protocol that accepts >1M HYPE, say 5M HYPE. 4M HYPE is vanilla staked and 1M HYPE is used for market deployment. Yield and fees can of course be shared with all stakers pro-rata. However, the staking yield and fees from the staked hype could also be used to incentivize maker liquidity in newer markets. The liquidity incentivization could take any of the following formats:

- Makers on incentivized markets are paid based on the volume they do on these markets.

- HLP-style vaults can be created which follow an automated strategy but source liquidity by directing yield to folks who LP into the vault.

Over time, we’ll find these strategies to be increasingly important since the UX of a financial product is directly dependent on the liquidity available on it. Even if there are n interesting markets on a DEX, if none of those markets are liquid then traders won’t be able to trade them. By foregoing immediate yield, stakers are investing in bootstrapping a DEX with higher sustainable yields in the future.

Taker Incentivization

The previous section provided a simple primer on how we can use staking yield or DEX fees to incentivize makers to provide liquidity on the DEX. Similarly, some or all of the staking yield can be used to incentivize takers on the DEX. Takers are often the organic flow on a venue and giving loyal takers fee rebates or loyalty bonuses can be a good way to keep them aligned with the DEX.

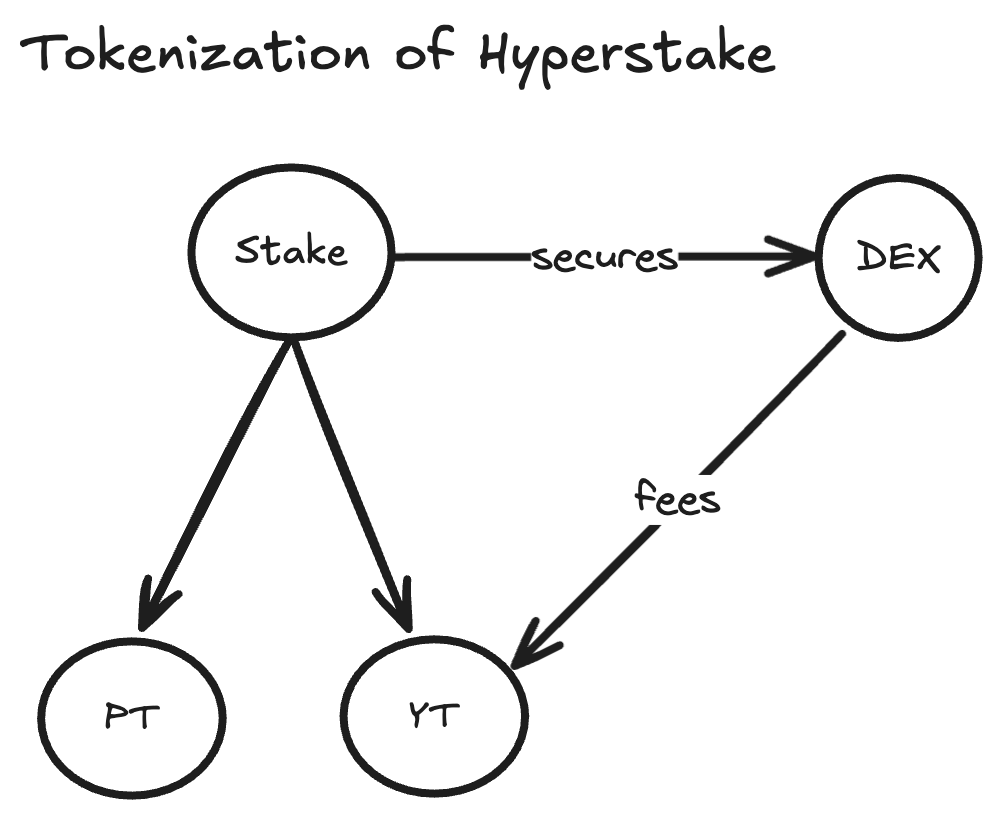

Fee Tokenization

Since a user’s staked HYPE position produces a stream of fees, one can financialize this stream. Similar to how protocols such as Pendle allow users to split a staked/restaked asset into principal and yield tokens, we can split a hyperstaked position into a principal and fee token. A DAO or individual staker could tokenize their claim on fees – issuing tokens that entitle holders to, say, the next 1 year of fee revenue from the DEX. They could then sell these yield tokens to investors, effectively bringing forward their cash flows. Yield tokens attract participants who want exposure to a market’s trading fees without owning HYPE. Buying yield tokens also provides a more capital-efficient avenue to earn DEX fees since buying a yield token would be lower than acquiring HYPE and then staking it.

Now that we have discussed the design space of staking to achieve the market deployment hurdle and fee utilization, we’ll dive into what makes HIP-3 special: new market types.

New Market Types

As previously mentioned, HIP-3 enables new markets to trade freely on the Hyperliquid L1. Deployers can bring an oracle feed, 1M HYPE and deploy a DEX permissionlessly. Every systematic trader that uses Hyperliquid should then be able to participate in these markets simply by changing some configs in their API calls.

But for traders to trade these markets, the asset listed on them must be interesting. Below we present some market types that may be interesting to traders.

Global Equities and RWA Markets

One of the most obvious categories to list includes RWA assets like US equities (such as TSLA or NVDA), commodities (like Gold), indices (such as SPY), and international stocks (like Rheinmetall or Tencent). These assets are excellent candidates for HIP-3 markets. The clear advantage over providing spot exposure to these assets is that spot would require accumulating inventory directly on Hyperliquid—a highly challenging task due to the fragmented nature of the exchanges these assets are listed on. In contrast, perpetual markets only require an oracle and a counterparty willing to provide liquidity at the oracle price, making them significantly more straightforward to establish on a standalone Layer 1 blockchain.

The key for these markets will be reliable oracle mechanisms and careful management of dividend adjustments or market closures, but those are solvable with clever market design and governance. Hyperliquid’s infrastructure commoditizes the exchange tech; the community just needs to bring the price data and demand.

Leveraged Markets

Builders can create perpetual markets that themselves represent leveraged exposure to an asset. For example, a 3XBTC perp mimicking FTX’s leveraged tokens like BTCBULL and BTCBEAR would be trivial to build with HIP-3. These tokens could maintain a target leverage of 3x and auto-rebalance daily to maintain their desired leverage exposure.

This might sound circular—a derivative on a leveraged derivative? However, it simplifies access to leverage for users who do not necessarily want to manage positions themselves (you trade the 3x market directly). Moreover, actual BTCBULL and BTCBEAR tokens can be minted as delegation vouchers to be used on the HyperEVM or as collateral on another HIP-3 DEX as well.

Portfolio Markets

Since a perp is effectively managed by a data feed, we can arbitrarily have it track a basket of assets rather than a single asset. For instance, the optimal portfolio construction in the last couple of months was colloquially expected to be {BTC, HYPE, FARTCOIN}. Instead of having to buy each asset separately, traders could simply long the BHF perp to gain exposure. Market makers can use their integrations across many exchanges to provide liquidity to the perp without having to build up the spot inventory for each asset on Hyperliquid.

Since we expect the optimal portfolio (both in terms of the assets and their relative composition) to change at least a few times a year, traders being able to fully rotate at the click of a button would give them unmatchable speed of execution.

Pair Trading

Another well-known market that HIP-3 enables are pair trades. The most common example of this is the ETH/BTC which has existed on Bitfinex for over 5 years. In a market regime with a meaningful amount of dispersion, pair trading becomes quite popular and the ability for a DEX-deployer to intelligently curate the right pair trades becomes paramount to attracting volume. Moreover, pair trading and portfolio markets can also be combined to make composite markets that could also become really interesting to trade directly on Hyperliquid.

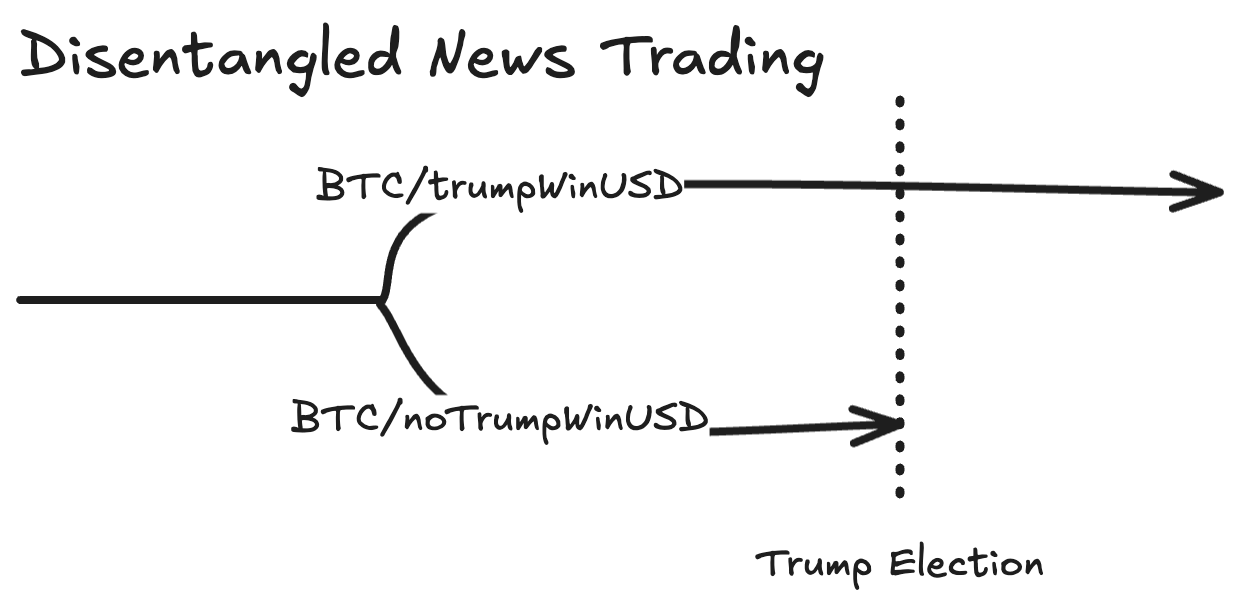

Disentangled News Trading

News—driven trading constitutes a widespread strategy employed around discrete informational events. In situations where market participants lack a-priori conviction regarding the outcome of an impending event, they often implement automated systems designed to execute trades immediately upon event confirmation. Because ex-ante positioning is uncertain, traders await the realization of the event and then rapidly establish long or short exposures. Competition among participants centers on minimizing latency in data acquisition and order submission; consequently, the trading process becomes a temporal contest in which success depends on optimizing the speed of information processing and execution post even happening.

“Multiverse Finance” is a term coined by Dave White at Paradigm to describe splitting the world into parallel price universes—a yes and no universe contingent on each resolution of an event—in each universe traders can hold assets that only “exist” if its corresponding outcome occurs. Holding both the yes and no tokens always recombines into $1, mirroring how prediction market shares work. One may construct contingent markets of the form yes BTC/yesUSD and noBTC/noUSD, in which traders can express their view on the price of BTC if the event happens or doesn’t happen respectively. Since the yesBTC/yesUSD market crystallizes to being canonical if and only if the event resolves to yes, market participants can express directional hypotheses regarding the second-order effects of the event without needing to directionally bet on the event or participating in latency games. Consequently, competitive dynamics shift from minimizing execution latency to deriving rapid and accurate insights into the event’s implications before it actually happens. Furthermore, by looking at the price trajectories of BTC/yesUSD, observers can obtain a transparent aggregate signal of collective beliefs regarding the likelihood and anticipated impact of the event.

Fee Perpetuals

One can also imagine a world where the earnings per HYPE for a DEX can be transformed into a HIP-3 market itself – allowing speculation on how successful a given builder-deployed DEX will be. Traders can now long one DEX and short the other expressing a specific view about their relative performance against each other.

Beyond staking, fee utilization and market types we think people can experiment with the fee structure and the margin system as well. Below we provide some short notes on experiments we think may be worthwhile.

Fee Structure

Hyperliquid’s fee structure is fairly standard today. DEX deployers can experiment with different fee structures to attract more liquidity. While customization is unavailable today, we expect fee structure modifications to become a part of future offerings for HIP-3. For example, a fee structure where traders only pay fees on winning trades can potentially become extremely popular (this fee structure was first introduced by Rollbit and was popular amongst its users). A trader could open many trades and close at breakeven, allowing them to take many shots at the same goal at no perceived cost. Another fee schedule that would make sense for equities would be to increase taker fees for users who want to trade beyond regular market hours. Since very few venues would offer 24/7 trading, and sourcing liquidity for these trades would also be harder, it makes sense to increase fees for a differentiated offering.

Collateral Management

HIP-3 turns Hyperliquid into a single-settlement, multi-venue ecosystem (since each new deployer makes a new DEX). It is unlikely users will be able to intelligently use their collateral across different HIP-3 DEXs by default due to the siloed nature of the DEXs.

Prime Brokerages in traditional finance were invented precisely to solve the problem of fragmentation across venues. Prime brokers bundle clearing, collateral management, and margin financing for hedge–fund clients so they don’t have to juggle many venues themselves. A Hyperliquid–native prime brokerage would play the same role onchain: track a trader’s net risk across multiple DEXs, passport collateral between them, and lend against the consolidated portfolio.

Conclusion: A New Era of Builder-Deployed Exchanges

Hyperliquid’s builder-deployed perps open a speculative yet exciting frontier for DeFi. By commoditizing the core exchange infrastructure and aligning incentives through the staking model, Hyperliquid is sketching the vision for a truly permissionless perp ecosystem. The design space we have discussed is vast and far more exciting than most realize at first glance. We’ll likely see a vast spectrum of DEXs built on top of Hyperliquid with unique staking models, market types, fee structures and financial products. This is directly in line with the overall trend we’re seeing in DeFi wherein the core protocol simplifies to only provide core functionality with all tasks needing ongoing management (such as risk management and market listings) being handled by competent third-parties. But we think this is especially powerful on Hyperliquid since perpetuals are the most used product in all of crypto.

Hyperliquid