Thanks to trace, myles, kratik, jim, felix, nanspro, emperor, cygaar, ren, rajiv, 0xlinguine and the Asula team for their thoughtful feedback and comments.

Liquid Staking is one of the largest product categories in DeFi. Lido, the biggest Liquid Staking protocol, is also the biggest DeFi protocol by Total Value Locked (TVL). Over the past year, Restaking and Liquid Restaking have emerged as another large category for DeFi, with EigenLayer and ether.fi also appearing in the top 5 DeFi protocols by TVL. In this piece, we explore the financial aspects of staking and restaking. We take a closer look at the similarities and differences between Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs). We also refer back to the concept of Delegation Vouchers, which was the original nomenclature for the product that eventually turned out to be LSTs. Finally, we discuss a few ways in which we foresee the LRT ecosystem evolve.

Return of the Delegation Voucher

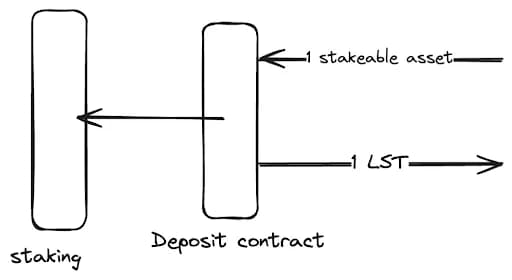

In 2019, Felix Lutsch wrote a blog post “Delegation Vouchers”, about a hackathon project by the Chorus One and Sikka Tech teams. They described a mechanism wherein users can delegate stakeable tokens with a validator on a Proof of Stake (PoS) network and receive claims to their underlying positions in the form of tokens called Delegation Vouchers. These Delegation Vouchers would allow users to participate in DeFi without having to suffer the opportunity cost of foregoing staking yield to do so. The definition of Delegation Vouchers, despite starting off specific to validator delegation, can be extended to include the delegation of tokens to any entity, like a protocol or a DAO. The voucher simply represents a claim to a commensurate amount of underlying tokens. The value of the voucher prices in trust in the delegatee, as they are responsible for honouring the redemptions of the underlying positions. As we already know, the most popular form of Delegation Vouchers we see out in the wild are Liquid Staking Tokens (LSTs). Users deposit stakeable assets to Liquid Staking protocols and receive a voucher (the LST) in return:

Liquid Staking Flow

Now, let’s get into some semantics.

What makes LSTs liquid?

LSTs are not liquid just because the delegation voucher is issued by the protocol users deposit assets into. They are assumed to be liquid because users believe they can earn PoS yield without facing the illiquidity risk that comes with unbonding periods on PoS networks. For the user to mitigate illiquidity risk, they must be able to sell their staked positions via the LST. In turn, there has to be resting liquidity willing to buy the LST. These marginal buyers are pricing in the risk that the entity controlling the underlying staked asset mismanages funds, and they are also pricing in the liquidity risk of the native token of the PoS network.

We see this can work in practice, with stETH usually trading at par with ETH (as marginal buyers believe the risk of Lido mismanaging assets is minimal) with a large amount of resting liquidity around the peg. However, exogenous events have resulted in instances where stETH has traded below its peg. For example, Celsius’ collapse in 2022 required them to liquidate a large amount of stETH before withdrawals were live for ETH PoS. This meant that the only ways for Celsius to “get out” of stETH were the liquidity pools on DEXs like Curve or the liquidity on centralised exchanges/OTC desks. (NB: If withdrawals were live for staked ETH, the ability to unstake would have provided a source of slow but unlimited liquidity to redeem stETH to ETH, potentially circumventing the depeg). These risks were unique to Ethereum’s transition to PoS since unstaking ETH was unavailable to stakers until early 2023, and the collapse of Celsius happened in mid-2022.

The following properties of LSTs trivially mean that they are delegation vouchers:

- Users that put tokens into a deposit contract are delegating their assets to Lido (which in turn delegates it across a group of reputable operators) in order to earn yield.

- Users receive an asset which acts as a receipt voucher for their position in the Lido Protocol. All rewards/risks are socialised across all users holding these vouchers.

Not all delegation vouchers are created equal. And they’re certainly not always liquid

While it may seem like delegation vouchers and LSTs are the same thing, we view delegation vouchers as a superset of LSTs. Just because a token has been minted against a position doesn’t actually imply that it is liquid by default (or even that it should be). For a voucher to be dubbed an LST, it has to have two properties:

- It must be a claim to an underlying staking position.

- It must have a meaningful amount of liquidity that allows holders to seamlessly trade in and out of it at near parity with the underlying asset. Achieving this liquidity is simpler in the case where the delegation voucher has one underlying asset (let’s say staked ETH), and the rewards are also in the same asset (as is the case with ETH staking). ETH is extremely liquid, so if someone were to buy stETH, they would be pricing the risk of being unable to unstake using Lido and sell the underlying ETH in the open market.

In a more general sense, LST protocols like Lido simply help users earn yield using a very specific strategy: staking ETH. More complex protocols like Yearn focus on generalised yield generation, and the delegation vouchers issued by such protocols are very often illiquid. In fact, even Ethena’s USDe asset can be viewed as a delegation voucher issued by the Ethena Protocol in exchange for the ETH used by the protocol to perform its delta-neutral yield generation strategy. In some ways, delegation vouchers act as the fabric of composability between protocols by allowing positions on one protocol to be utilised on another.

A delegation voucher is a necessary condition for an underlying position to be liquid, but isn’t sufficient. The complexity of the underlying strategy, the shape of the delegation voucher, and the size of the underlying asset’s liquidity all go on to determine whether marginal buyers (and thus liquidity) exist for the voucher.

Restaking adds multiple dimensions to staking

This brings us to restaking: restaking is a generalisation of staking wherein the same asset can be used to secure multiple networks, called Actively Validated Services (AVS) in the Eigenlayer nomenclature. Restaking itself is an opt-in process that requires users to choose to restake their assets to a new network or AVS. In turn, these AVSs would need to incentivise stakers to restake their ETH with yield. The opt-in nature of restaking makes it complex for users since they need to evaluate opportunities based on:

- The operational risk associated with any given operator that runs AVS software

- Which AVSs the operator supports

- How much stake the operator delegates across those AVSs

Each degree of freedom created by the general nature of restaking makes strategising the optimal restaking position more complicated for the user due to the increased risk of slashing that comes with daisy chaining of restaked positions (in the absence of any risk, the optimal strategy is to restake to all possible AVSs). There may even be technical barriers to restaking, making it even more likely that users delegate their ETH to professional strategy managers like ether.fi, Renzo, Mellow or Puffer Finance. The delegation vouchers issued by these protocols are commonly dubbed Liquid Restaking Tokens (LRTs) and have enjoyed early success in the market.

LRTs vs LSTs: similar but different

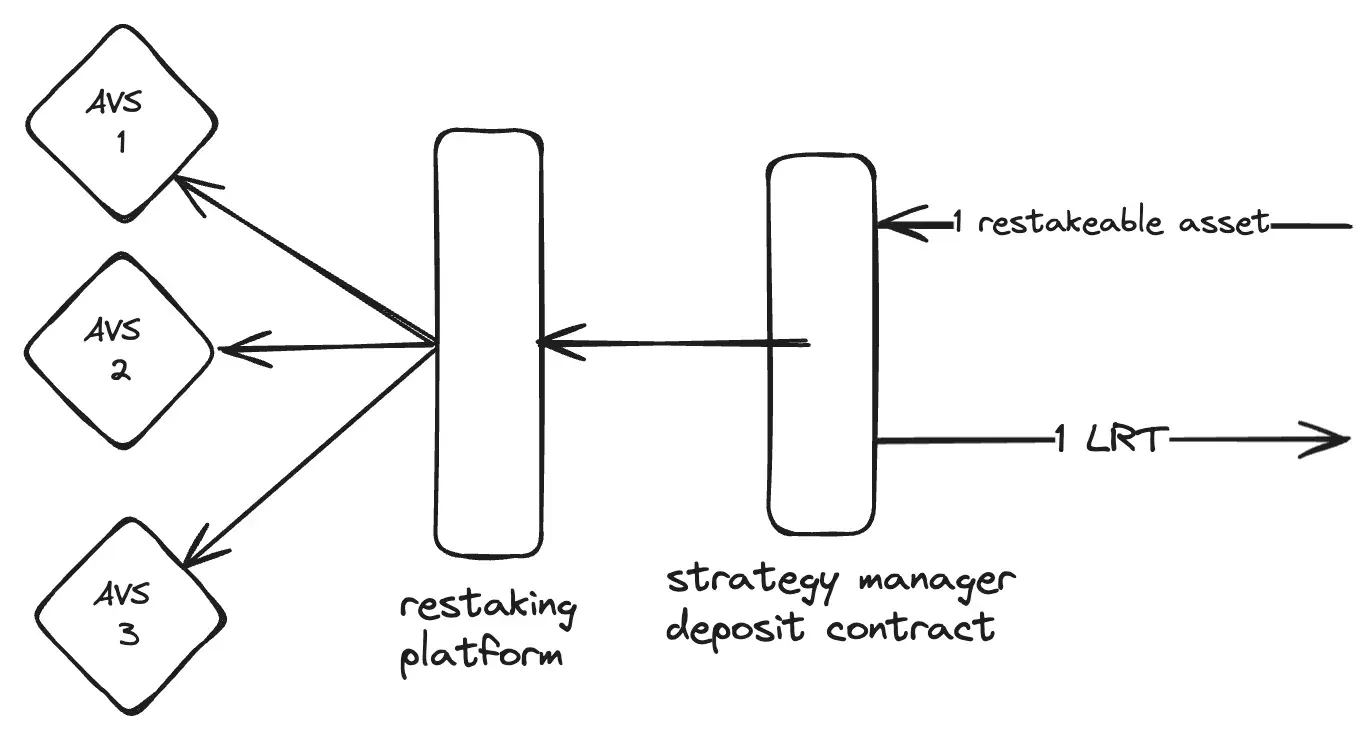

The structure of an LRT protocol looks very similar to an LST protocol:

- User deposits ETH into the deposit contract of a strategy manager (like ether.fi, renzo, mellow or puffer).

- User receives LRT tokens (a delegation voucher) corresponding to their staked ETH position.

- The strategy manager protocol uses a restaking platforms like Eigenlayer and Symbiotic to distribute stake across different operators and underlying AVSs based on a predetermined allocation methodology (this is the strategy employed by the protocol).

Liquid Restaking Flow

Broadly, LRT protocols look a lot like LSTs. So, one might expect similar dynamics to play out in terms of liquidity. At a high level, it may appear as if LRTs are very similar financial instruments to LSTs; however not all delegation vouchers are created equal. Here are a few ways LRTs are different than LSTs:

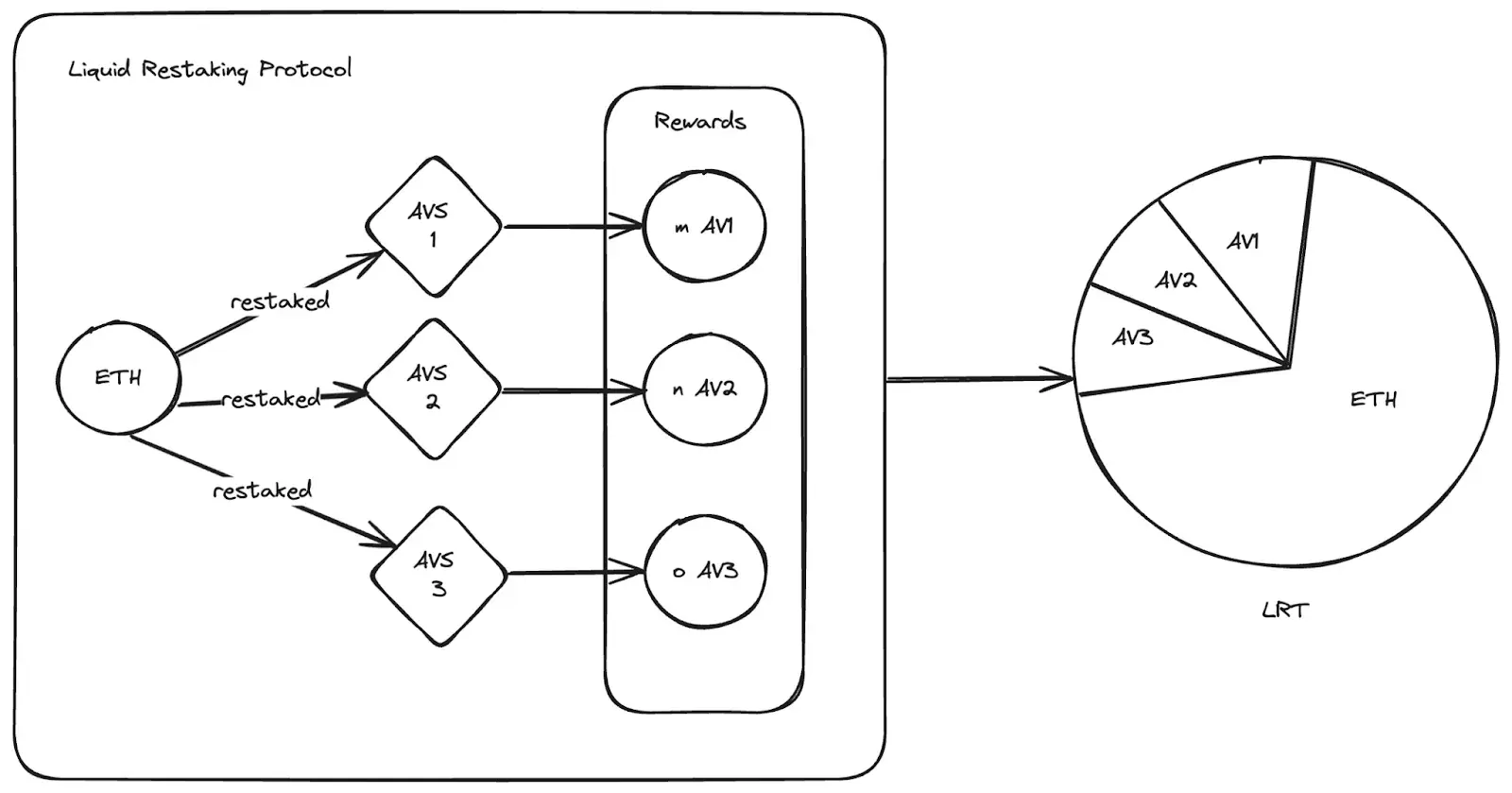

- LRTs, despite starting off with ETH deposits, earn AVS tokens as additional yield to the native ETH yield. This makes their backing collateral composed of multiple different tokens (this also turns their overall naming scheme of {prefix}ETH a slight misnomer).

- LRTs might choose to stake these AVS tokens to earn additional yield (just like Lido compounds all ETH rewards).

These differences potentially transform LRT protocols into multi-asset, multi-strategy yield maximisation protocols, even if they issue just one delegation voucher dubbed {prefix}ETH. In general, the shape of an LRT today makes them look very similar to LSTs. AVSs haven’t begun emitting tokens, so LRTs haven’t yet had to make decisions on how to treat these AVS tokens and how to structure their overall product. We’re starting to see a fork in the road, though; with multiple restaking platforms live on the market, existing LRT protocols face the question of integrating multiple restaking platforms under the same delegation voucher product, or they could create a delegation voucher per restaking platform.

The devil and the deep blue sea: liquidity fragmentation vs risk management

ETH staking yield is regarded as the risk-free rate in crypto, and thus, the largest LSTs trade at par with their underlying collateral value. On the other hand, even if all LRT rewards were denominated in ETH, AVS commitments have higher risks due to added slashing conditions. Naturally, there should be some risk-based discounting to the value of the delegation voucher from the LRT protocol. This discount does not manifest in the market today due to the lack of slashing on Eigenlayer. Moreover, since some portion of the LRT’s underlying will be tokens other than ETH, the LRT’s resultant liquidity will not just be a function of ETH’s liquidity (as is the case for LSTs) but will also depend on the liquidity of the other assets the LRT is composed of. If an LRT earns 20% APY from restaking and chooses to hold the AVS tokens earned (versus sell them into ETH), then a large portion of the overall backing of the LRT will go from being ETH-denominated to being denominated in a basket of tokens encompassing the original ETH along with earned rewards:

LRT potential composition (pie chart not drawn to scale)

It is possible that the LRT chooses to sell AVS tokens in an attempt to homogenise their backing, but in such a scenario, they might antagonise potential AVS partners. In a world where most AVSs don’t need billions of dollars worth of cryptoeconomic security, LRTs are competing against each other to secure AVSs. To build goodwill LRTs are unlikely to sell AVS tokens, especially whilst an AVS is in its infancy. With protocols like Symbiotic making it possible to restake/stake AVS tokens, it’s also inevitable that future security agreements between LRTs and AVSs are structured in a way where LRT protocols stake AVS tokens instead of selling them. This ETF-like composition of LRTs should limit the overall liquidity available to them and also limit their capacity to become quote currencies for other assets or units of account (stETH has become an ETH equivalent unit of account for a large sect of crypto natives, being used as a replacement for ETH on L2s like Blast). As previously mentioned, not all delegation vouchers are created equal. Liquidity for mature LRTs will be harder to achieve than it is for LSTs.

Possible Future Scenarios

Up until this point, we’ve described how we believe LRTs differ from LSTs despite their similar-looking composition. The market structure for restaking is still in its infancy and is likely to evolve over time. We’ll try to pose a design for a liquidity layer that might circumvent some of the liquidity challenges we posited LRTs might face in the future.

LRTs backed solely by blue-chip AVSs

Over time, we expect the difference between staking and restaking to blur, similar to how Ethereum issuance, execution fees, and MEV rewards are all considered under the default reward rate. The risk-free rate on ETH may evolve to include some blue-chip AVSs with sustainable yield. In such a scenario, we might expect large LSTs to include these blue-chip AVSs in their overall strategy. Current LRTs may also pursue a future wherein they focus their stake on large blue-chip AVSs exclusively. Large AVSs earning sustainable yield through transaction fees will potentially earn these fees in ETH and, thus, directly increase the “risk-free” rate on ETH. Even if the yield is in the AVS token, having a sustainable revenue source should create enough liquidity for the AVS token to allow LRTs to convert the yield into ETH.

LRTs for long-tail strategies

Beyond the expansion of risk within the risk-free rate, we expect AVS adoption/growth to accelerate over the next few years. This would mean a demand for the long tail of restaking yield strategies. These strategies could span new restaking platforms like Symbiotic, experimental AVSs and even explore staking AVS tokens to earn additional yield. Beyond expanding to new technical products, we expect the financial shape of strategies to evolve by incorporating features, such as fixed-term yield generation, allowing AVSs to delay yield in return for upfront security (similar to how venture capitalists provide capital to startups in exchange for vested equity/tokens) among other things. The team at Timewave wrote an excellent post talking about more such features for LRTs to explore.

A CDP-inspired approach to unifying LRTs

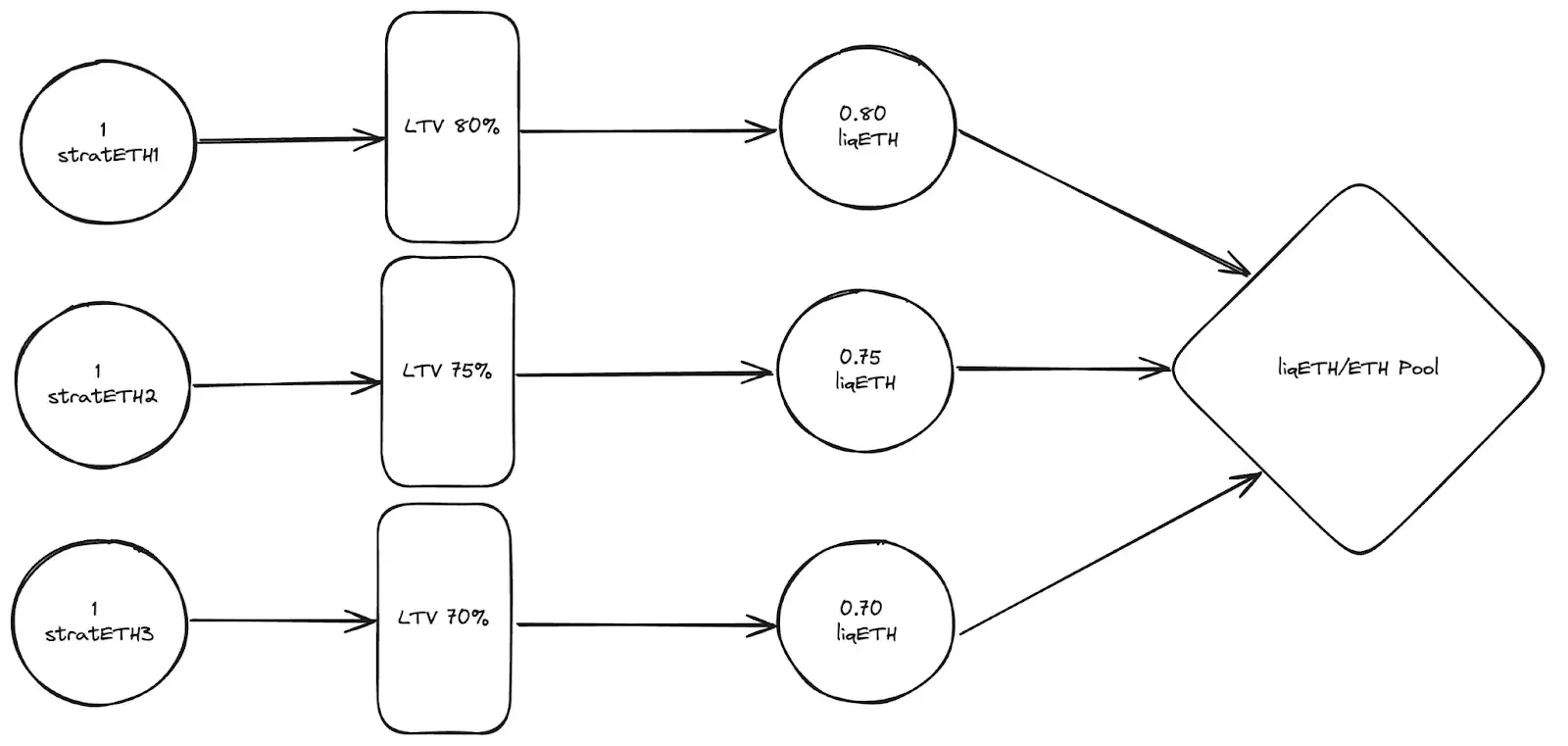

One issue for the long-tail of strategies would be capital efficiency. If the delegation vouchers issued by most restaking strategies aren’t liquid, then users have to choose between restaking to the long tail of AVSs or having their assets available for use in DeFi (this is similar to the competitive equilibria that existed between staking and DeFi in the early days of staking). Taking inspiration from our understanding that there are two aspects to Liquid Restaking Protocols: the strategy and the liquidity for the delegation voucher, we propose a modular design involving a new synthetic asset pegged 1:1 with ETH.

Let’s say there are three separate delegation vouchers issued against restaked ETH positions: stratETH1, stratETH2 and stratETH3, each representing a different restaking strategy. If each of these assets were to have large liquidity pools quoted in ETH, they would fragment liquidity. There would also be potential arbitrage opportunities in these liquidity pools as the underlying strategies earn AVS rewards and the value of the delegation voucher increases. This could lead to LPs in these pools leaking rewards to arbitrageurs and block builders/sequencers. Instead, we propose a lending-based design that includes tranching at the LTV-strat layer, preventing fragmentation of liquidity of the underlying LRT while still segmenting the risk of the individual strategies in accordance with LTVs that are proportional to the risk of those strategies:

CDP LRT Flow

The liquidity layer would allow users to deposit stratETH tokens into different vault-like structures and allow the users to mint a synthetic token pegged to ETH 1:1; we call this token liqETH. The amount of liqETH users can mint depends on the overall risk of their underlying restaking strategy. As the risk of a long-tail strategy increases, the amount of liqETH minted can be adjusted downwards to reflect this risk.

Advantages:

- The separation of the strategy selection and liquidity layer would also allow strategy manager protocols to focus on offering multiple strategies without requiring them to worry about making each strategy liquid.

- Since users create their own vaults within the liqETH protocol, the risk would be stratified across users and strategies.

- Moreover, since restaking strategies use ETH as the base asset and liqETH is minted as the debt asset, the risk of price-based liquidations reduces greatly compared to minting a USD-denominated debt asset. The liquidity protocol just needs to price the risk of slashing, given a restaking strategy and being able to withdraw the underlying ETH from strategy manager protocols.

- If the liquidity layer were offered independently of the strategy managers, it would also create a credibly neutral point of trust for risk quantification across different restaking strategies.

This design is just one possible solution to the problem we see occurring with LRT-like delegation vouchers in the near future. We arrived at this design by disentangling the tasks an LRT protocol must perform. The overall design space for financial instruments on top of restaking protocols is vast, and the industry hasn’t even started experimenting with these financial products yet.