Thanks to Krane and Rajiv for their comments and feedback.

Stablecoins are a defining utility for crypto and display how blockchains offer superior infrastructure to legacy payment systems. In the last 12 months, the total stablecoin market capitalization has grown over 50%, with a recent surge in growth since Trump’s re-election in November.

Generally the benefits of stablecoins are understood by people in the industry because they are so closely tied to a core utility of blockchains – the instant movement of money and value. However, while stablecoins offer a solution for executing payments, execution is just one part of the equation when we look beyond p2p transfers.

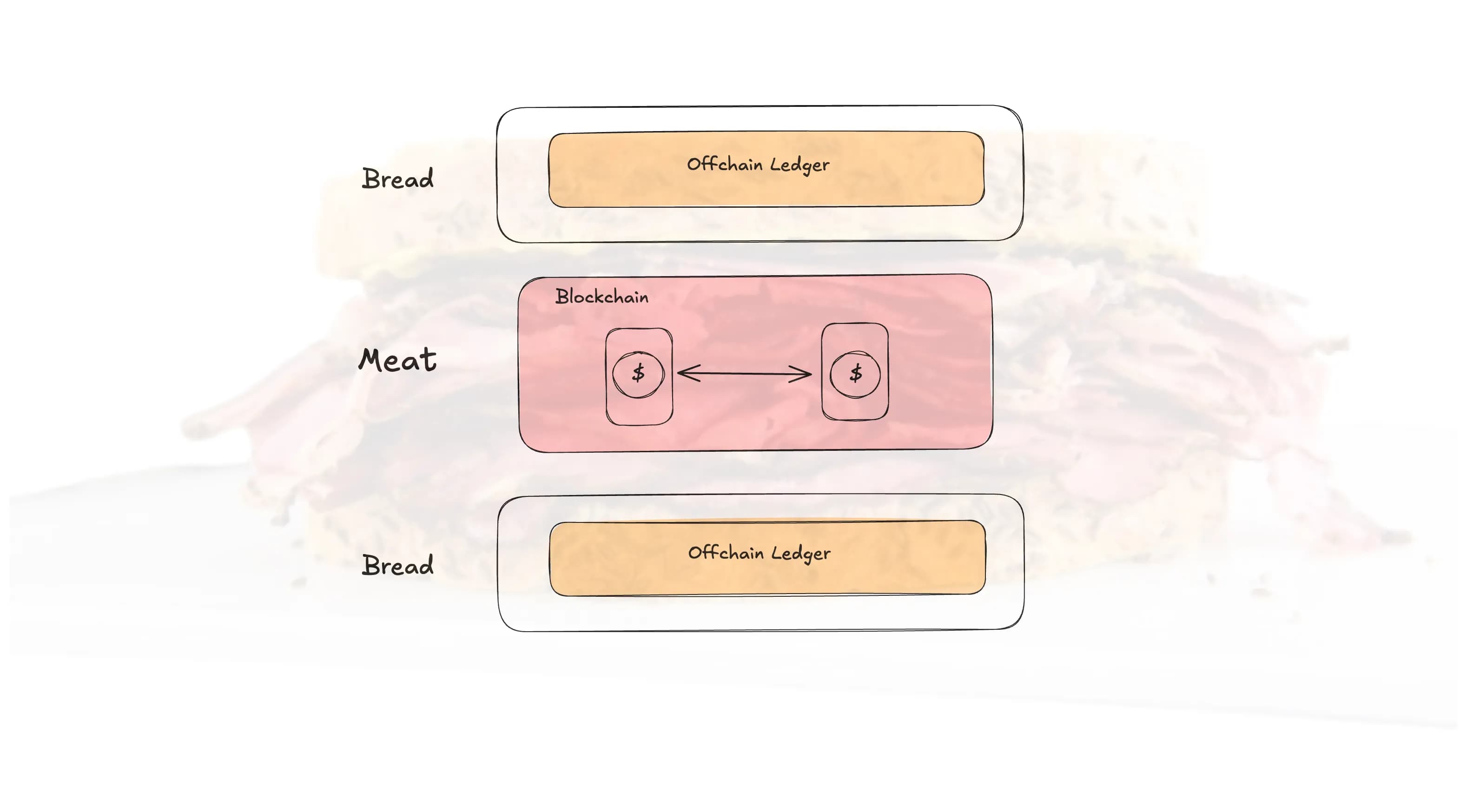

The stablecoin applications for businesses today use blockchain in a way where it is “sandwiched” by traditional rails. In practice this sandwich gives us a lot of improvements compared to traditional options, although the ends of our sandwich also add limits to how far we push benefits from blockchains in practice.

The sandwich structure is most prevalent in applications for global payments. This post will work through the existing systems for global payments, and unpacks where the stablecoin sandwich offers improvements in use cases of treasury management, B2B payments, and card network settlements. At the end we’ll discuss outstanding challenges we need to overcome to remove the ends of our sandwich.

The sandwich structure is most prevalent in applications for global payments. This post will work through the existing systems for global payments, and unpacks where the stablecoin sandwich offers improvements in use cases of treasury management, B2B payments, and card network settlements. At the end we’ll discuss outstanding challenges we need to overcome to remove the ends of our sandwich.

Background on stablecoin payments

Across applications for stablecoins, business payments have seen the most traction. The most recent Artemis report presented data from payment companies that showed monthly B2B payments increased from $770m to $3b in the last year. Fireblocks also reported that stablecoins accounted for nearly half of transaction volume on their platform, with 49% of customers actively using stablecoins for payments.

Specifically global payment use has grown in popularity, as benefits from stables are magnified when infrastructure is more outdated; SWIFT and correspondent bank networks are successfully facilitating over $100T in global payments volume yearly, however businesses & banks are still subject to significant complexities and delays, many of which we will show are avoided with stablecoins.

Global payments infrastructure today

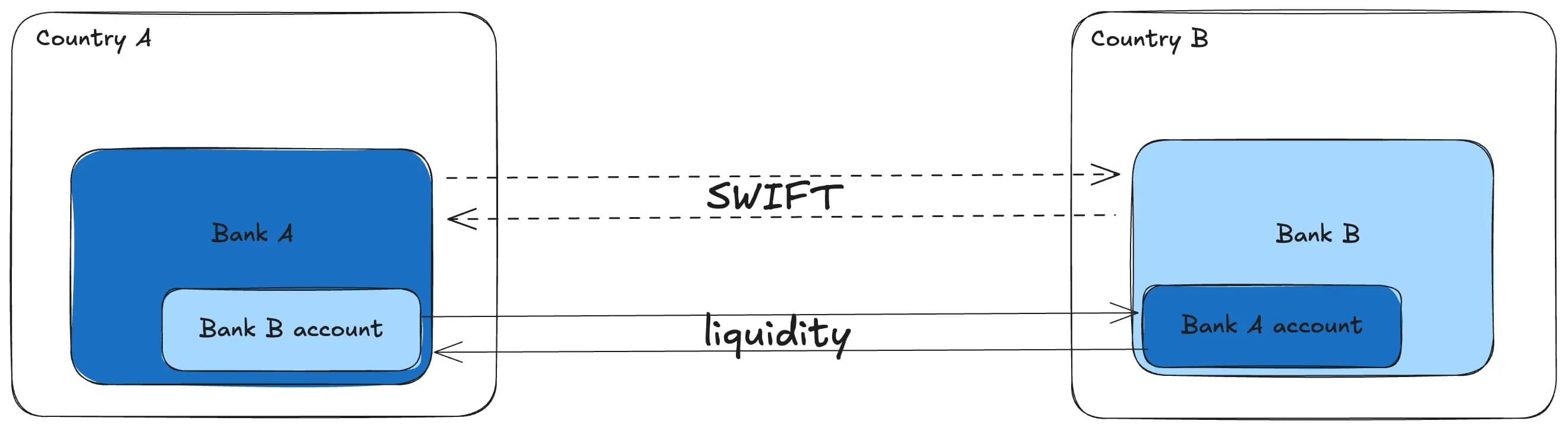

First let’s look at how global payments currently operate. For a transaction between banks in different countries, the process is separated into messaging and execution. SWIFT provides messaging between banks for transfer guidance, but the actual movement of liquidity occurs between banks that have directly integrated accounts to do debit/credit transfers.

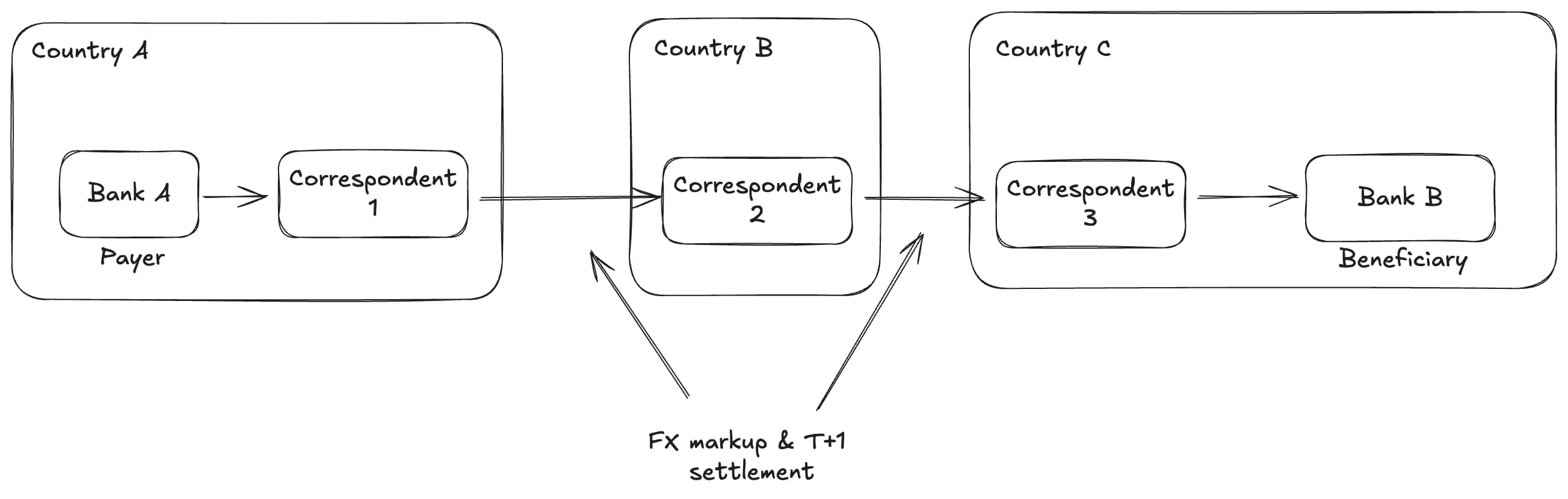

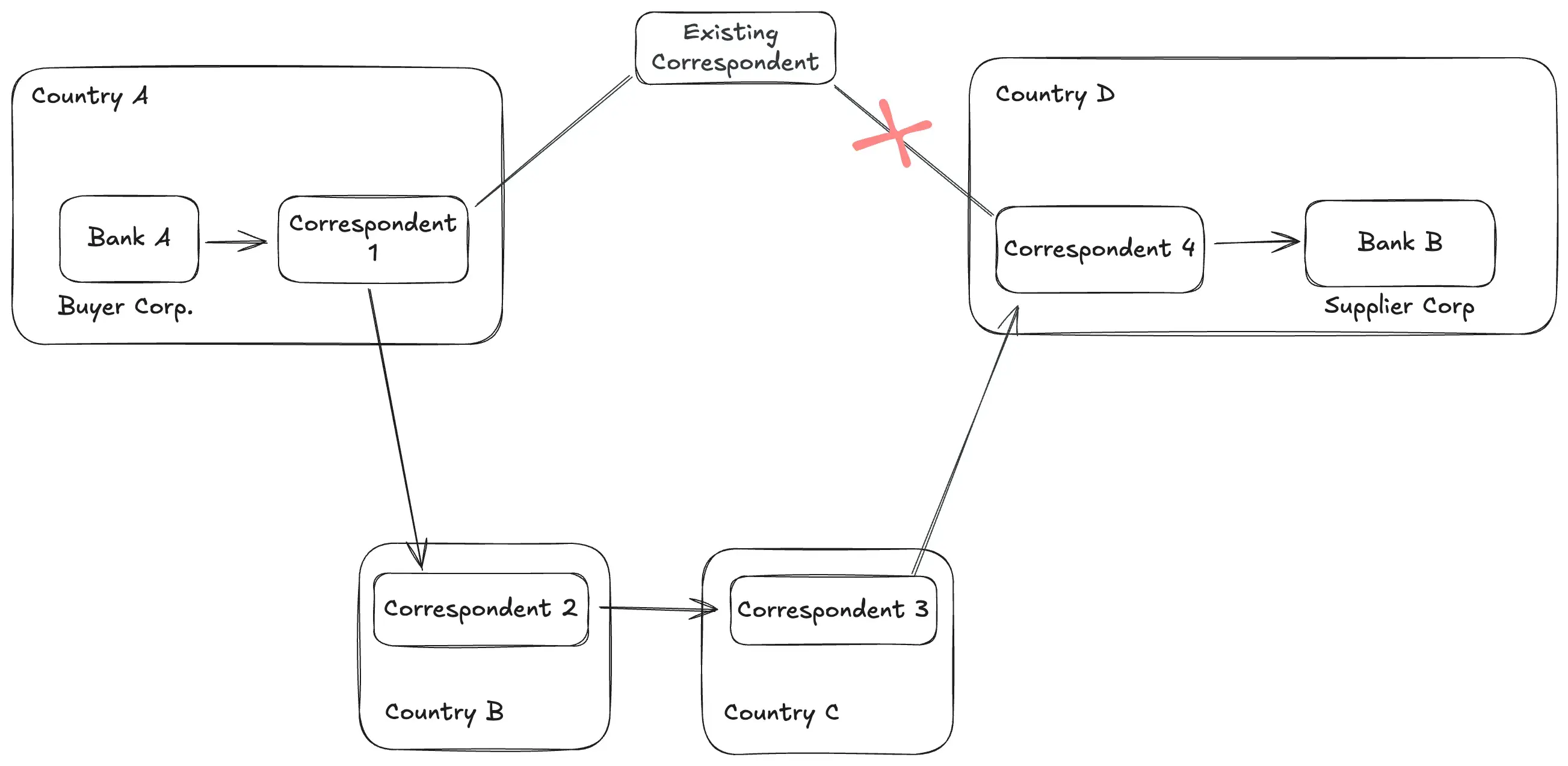

Both banks must be connected to SWIFT and onboarded with each other as partners for a transfer to work. If they are not, then correspondent banks with the correct integrations and liquidity must be chained together to execute a transfer. Below is a basic example of a SWIFT network transaction, which uses common correspondents to connect two disconnected banks:

Multi-day settlement times, higher fees, tracking challenges, and other issues surface as more intermediating banks are required.

Cross Border Money Transmitters

The above case is technically how a payer executes an international wire transfer today – and it shows us why a business requires its bank to be connected with SWIFT and offer a path through a desired corridor for payment.

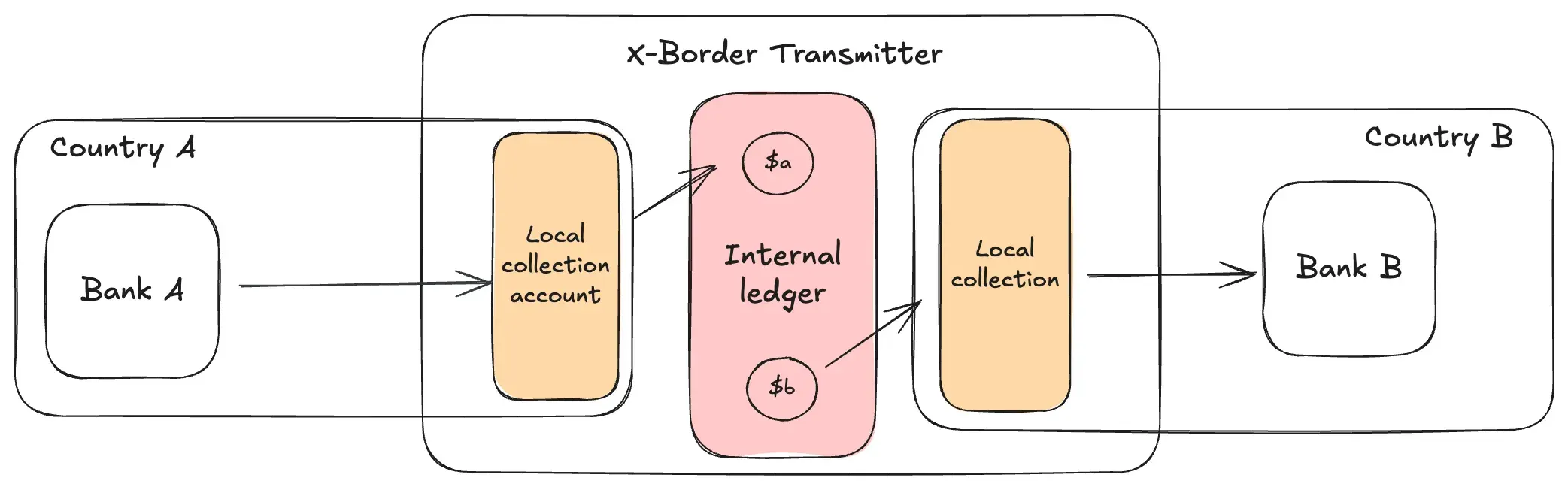

Cross border money transmitters (XBMTs) are the main solution to offering global business payments without subjecting the end business to a direct SWIFT transfer. These are also referenced as “global currency accounts” or “local collection accounts”, but functionally the end service is the same: access to multiple currencies to make payments across multiple countries.

How they work

An XBMT manages compliance and banking relationships, while businesses or individuals get a single multi-country banking product. They have a “closed loop”, meaning there are no external operators or dependencies that add costs or complexity. If this was a sandwich, the internal ledger would be the meat of the sandwich, and the local collection accounts in each region would be the bread. Liquidity is internally managed across accounts:

XBMTs are actively serving a portion of the global market for b2b payments and treasury management. The existing closed loop services today prepare and move liquidity for end businesses as needed. Since they manage the full process they dictate controls and limits for clients.

XBMTs are still built on top of SWIFT rails and employ clever methods to manage liquidity and enable timely payments. This is very similar to how intent-based protocols like Across can allow instant transfers between two optimistic rollups despite there being a 7-day fraud proving window. However these designs are constrained by the amount of liquidity available to the XBMT in a specific country and thus are limited by the speed of settlement for the rails they are built on.

Stablecoins are just better

Whereas XBMTs are structured products for a global business use case, stablecoins are a more fundamental improvement; they offer a path to restructure how commerce is conducted on the internet by using blockchain rails.

The settlement period for stablecoins is equivalent to the block time of the blockchain the stablecoin is issued on, which is a step function improvement in settlement time compared to SWIFT & correspondent bank transfers. Any system relying on these methods can effectively be replaced by a shared, verifiable ledger tracking stablecoin issuance and ownership.

In addition, since stablecoins normally live on smart contract platforms, more innovative systems and workflows can be built in a way that would be impossible on traditional banking rails. For example, for any program or logic to be added to an XBMT, the XBMT would need to go to each bank in each country to integrate this logic via APIs. The usage of open, verifiable protocols allow systems to add functionality to any stablecoin (for example, by using ERC or SPL standards) without requiring permissions from any single party.

In many ways, faster and more expressive finance directly increases the GDP of the world. If businesses can get paid faster, they can use the money for downstream processes faster, and can avoid overhead or costs that come with managing settlement delays. There are ripples throughout economies when settlement periods are compressed from days to seconds or minutes. Furthermore, the existence of verifiable standards or protocols allows for financial innovation to happen at a global-scale that was fundamentally not possible before.

Stablecoins in global payments

Given the above benefits, we can now breakdown specific global payments use cases that benefit from the use of stablecoins. We’ll go through the how global treasury management, global B2B payments and card network settlements operate today, and discuss the application and benefits of stablecoins across each.

Global treasury management

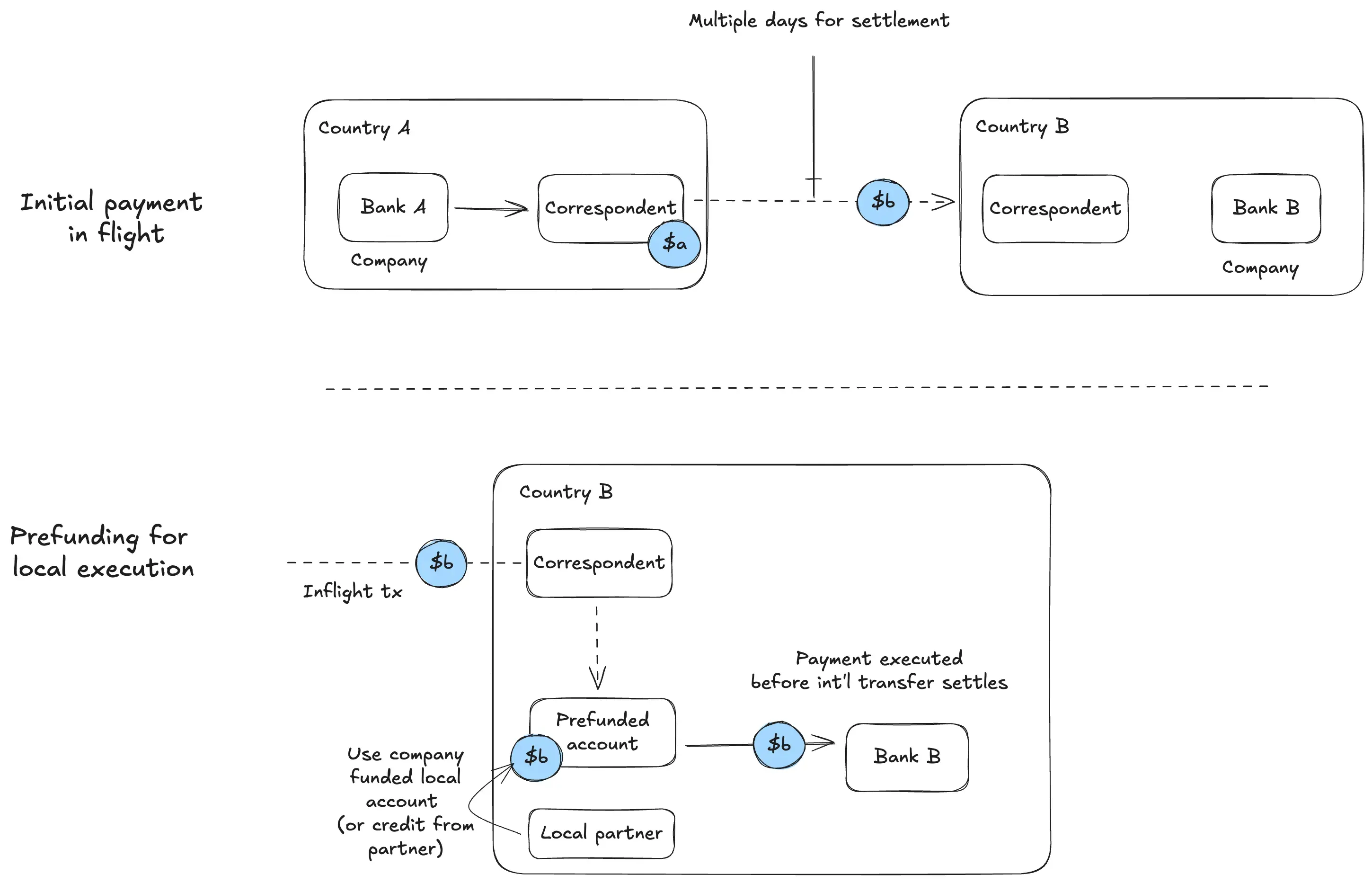

Consider the case of global corporate treasury management: for example, a company has payment obligations in country B in currency b at a certain date. They must prepare money movement from currency a in country A before payment is due:

This is the prefunding process, where finance teams must account for a lead time for timely execution of a payment.

The team must have an account on the domestic rail ready to execute a payment on time. Sometimes to support this a company might pursue short term loans from partners in the region. The longer global settlement drags on, the more exposure to FX risk and the greater capital requirements for the treasury. Managing derivatives to hedge currency exposure and figuring out short term liquidity add large operational overhead for businesses seeking to simply execute a global payment.

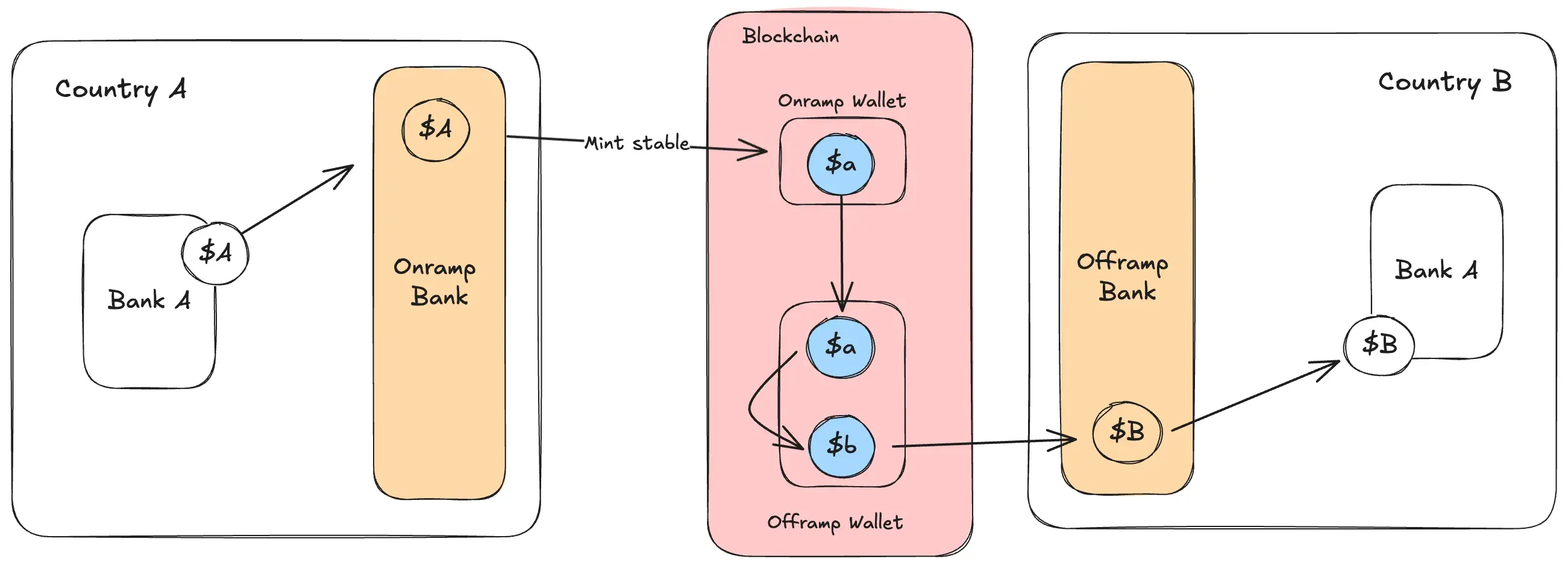

Stablecoins simplify this system by removing the requirement to control for delays in international settlement:

We can see the function of our sandwich here; While the initial on and offramping must touch fiat systems on both ends, stablecoins exist in facilitating transfers between ramps.

By using stablecoins, processing has shifted to a domestic transfer in both country A and B, with the blockchain settling the global liquidity exchange between parties in the middle. (Note: for such a swap to go through, there must be onchain liquidity to go from $a to $b)

Global B2B payments

The process for global B2B payments is similar to treasury management, however the B2B case can see greater benefit since B2B payments can be more complex and may be dependencies for other parts of a business operation.

For these payments, banks in different countries may be connected to the delivery of a service or goods. This can mean parties are more sensitive to tracing progress of the payment. For example, in the prefunding diagram above, the cost of the prefunding might depend on the status of an inbound payment.

Furthermore, if businesses are transacting in a corridor that is less popular, they may need to use multiple international hops – this might not have a clear system for communicating the payments progress, and can subject a payment to timing delays since banking hours are not 24/7.

Let’s look at another example, where a business in country A wants to pay a business in country B, and the banks in these countries do not frequently transact. If bank A does not have connections in a suitable corridor to send payment to country B, the payment takes an extra hop:

A number of added benefits emerge at the business level when these payments are executed via stablecoins in between:

- Both parties can cleanly manage and monitor payment status

- Financing can be tied to time sensitive materials and deliveries, thus businesses that depend on timely arrival of goods avoid large risks or delays

- With lower risk for such business, we can expect lower capital costs and higher velocity for capital; this should lead to considerable productivity gains at a global level as stablecoin integrations mature

Similar to the treasury management case, the requirement for correspondent links, prefunding, and most FX exposure are largely removed. The working-capital requirements are meaningfully smaller and less complicated when the entire process can take seconds rather than 3 days, and does not have to control for market closures.

Card network settlement

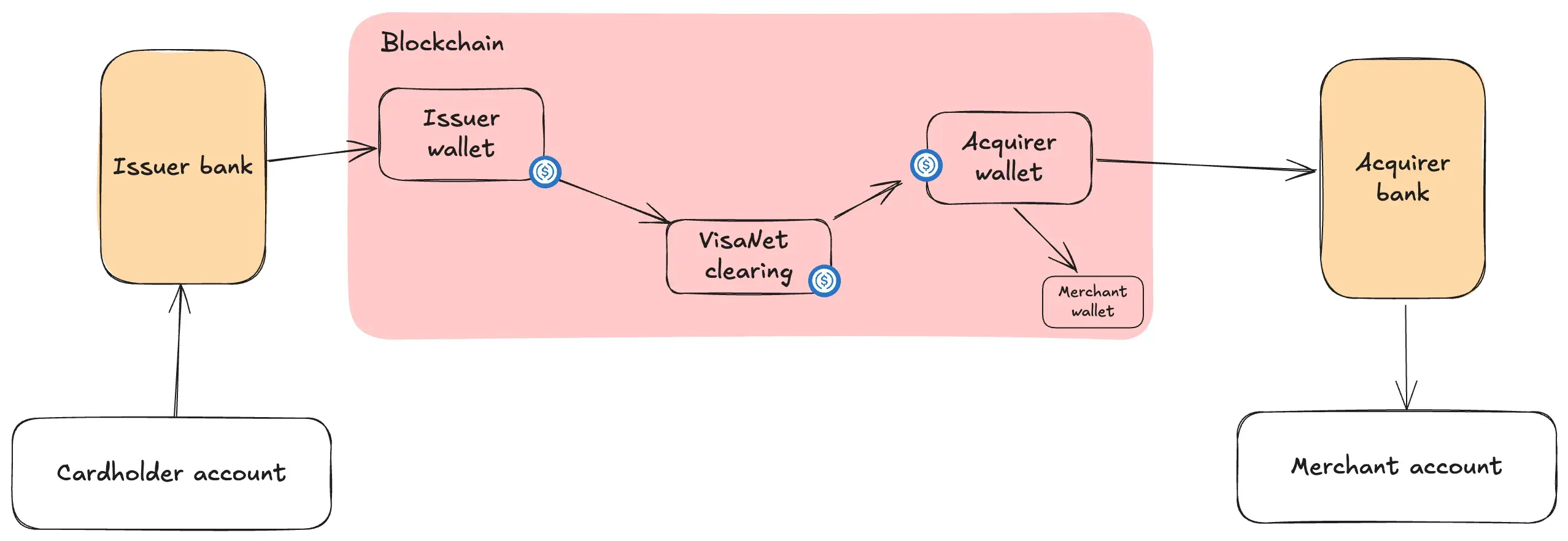

In card networks, an issuing bank for a card will send payment on behalf of a card holder to a merchant’s acquirer bank, which receives and credits payments to a merchant’s account. These banks do not settle obligations directly; they are each onboarded to VisaNet, and Visa nets and settles between the banks during banking hours on weekdays. Each bank must maintain prefunded balances to enable timely wires.

Visa has been piloting acquirer to issuer settlements in stablecoins as far back as 2021. This use of stablecoins replaces the wiring process to instead use USDC on Ethereum as well as Solana. After card authorisations are completed for a given day, Visa debits or credits banks on either side of the transaction with USDC:

Since the system occurs within VisaNet, the net effect benefits partners in the network. This is most comparable to the closed loop system of an XBMT, however the massive scale of the card network pushes benefits to the issuer/acquirers (because they previously had to manage the global payment).

The upside from stables is similar to the treasury management case, though instead these benefits go to banks within the network: they can reduce capital requirements necessary for making timely international transfers, and thus avoid FX exposure. Additionally the open, verifiable and programmable traits from blockchains lay the foundations for credit and other financial primitives between banks within VisaNet.

Less carbs, more protein

It should be clear from our discussion above that the stablecoin sandwich is useful, however today most adoption of stablecoins are not pushing beyond instantiations of this system. Why is this the case? Can we move to a steak rather than a sandwich?

Very few businesses use onchain payments and stablecoins. For any activities that require them to touch fiat rails, we add bread to our sandwich. We are adding protein to a previously vegetarian sandwich, but it’s still a sandwich.

The goal is to remove the ends of our sandwich completely. As businesses or consumers embrace stablecoins, full-cycle finance and commerce can take place on blockchains, and we no longer need to deal with restrictions from inferior traditional rails. Financial institutions and companies fully transacting in stablecoins unlock commercial scale that is unprecedented. With less friction for businesses to build, operate and serve globally, the trajectory of the world’s GDP when operating in stablecoins can grow at a rate closer to the true consumption of goods, services and content on the internet.

This piece unpacks how traditional payment systems are improved by using blockchains sandwiched between domestic rails. However if we can graduate from our sandwich structure, the velocity of globalization can enter truly unprecedented territory.